Incrementality is easily overlooked during a period of economic expansion. We would argue that doing so is bad business when environmental conditions are good. Further, failing to understand the contribution of incrementality versus transferred demand in a downturn can be a fatal mistake for marketing managers. The effectiveness of snazzy advertising and must-have product features tends to drop off at the same rate as disposable income declines, but pricing is a tool that is always there for you.

It is easiest to see the incrementality issue manifest itself in assortment questions given that there is no reason to provide shelf space to a SKU that will cannibalize the rest of the portfolio. Pricing is a little trickier to directly address, but a portfolio pricing strategy that is not easy for shoppers to immediately understand means they will spend their money elsewhere. This was paramount in a project recently completed in Southeast Asia.

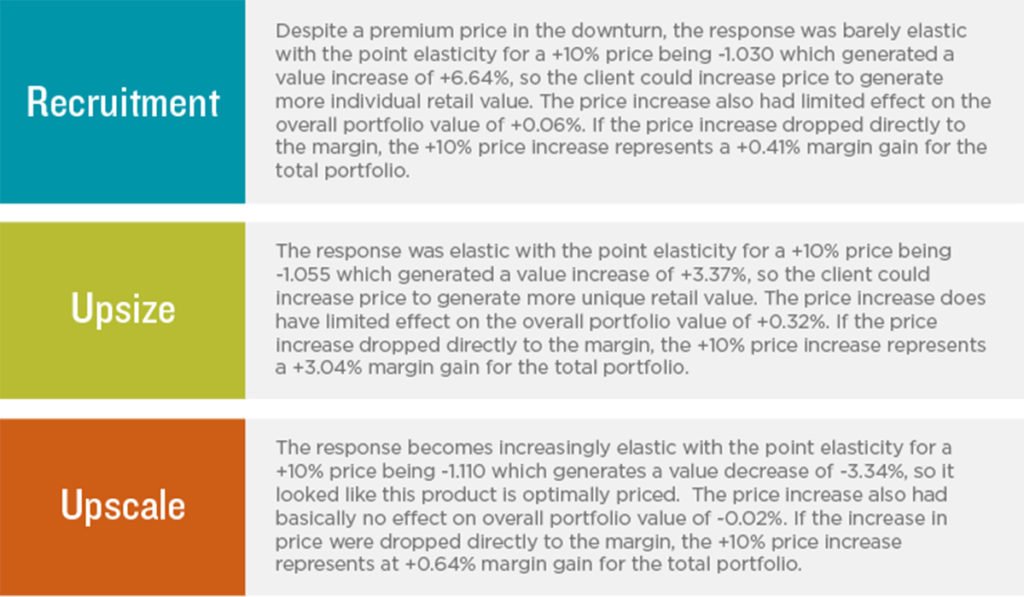

Our initial analysis of the existing assortment repositioned the client portfolio to focus on recruitment, upsize, and upscale packages aligned with product roles explained in a previous blog. We subsequently looked at the price response and translated the results into elasticities, which we also discussed in another previous blog:

Utilizing these results, Middlegame proposed the greatest change to the upsize packs with a +10% increase which still represented a 45% volume discount versus the upscale packs. The recruitment packs could also take advantage of the value increase, but to align the prices for easy shopper evaluation, prices were only increased by +5%.

The Competitive Interaction Analysis (CIA)® platform estimated that the price increases would pull down overall units, but increase value as expected and provide an enormous boost to margin if the assumption stands that total price increase drops to bottom line. Portfolio units are expected to decline -2.3% while volume also falls -3.4%, but retail value gained +3.1% while margin grew +24.9%. It was a better pathway to increased profitability in the downturn than any other initiative.For retailers, overall value was expected to grow +2.4% from a category unit reduction of -2.4% as well as -3.1% of total volume sold. This suggests a distinct profitability increase because of the lower cost of handling which the client salesforce is currently using as a selling point. We do not know the results yet, but the initial feedback has been favourable as the increase in margin has been recognized in the stores enacted. A data-driven approach can certainly discourage slashing prices in a recession.

Middlegame is the only ROMI consultancy of its kind that offers a holistic view of the implications of resource allocation and investment in the marketplace. Our approach to scenario-planning differs from other marketing analytics providers by addressing the anticipated outcome for every SKU (your portfolio and your competitors’) in every channel. Similar to the pieces in chess, each stakeholder can now evaluate the trade-offs of potential choices and collectively apply them to create win-win results.