Market Structure has always been one of the three key elements of the CIA® platform for the assessment of assortment, pricing, merchandising, and sometimes media. Basically, our Market Structure is the first step in the modeling architecture that identifies the structure of competition among SKUs in a competitive category. Market Structure is one of the inputs for determining the drivers of Market Share simultaneously for all competitive SKUs in the category (transferred demand) as well as estimating the drivers of Market Size across geographies and time periods (incrementality).

Recently, clients have been asking us about Market Structure. That’s because we can apply our methodology in a far wider number of channels than traditional tools that are limited to household panel or frequent shopper program data. I spoke a little about this in an earlier blog called Reliance on retail tracking data to deliver category-wide analytics . This level of interest has suggested that we introduce a new service based solely on our Market Structure approach. So we’re highlighting the capability in this blog.

The CIA® platform defines every product based on a series of attribute options that represent the needs satisfied. It then derives a series of elasticities and cross-elasticities for these attribute options leveraging a technique called Bayesian Seemingly Unrelated Regressions. The coefficients or weights are then used to calculate Euclidian distances for each SKU from every other SKU.

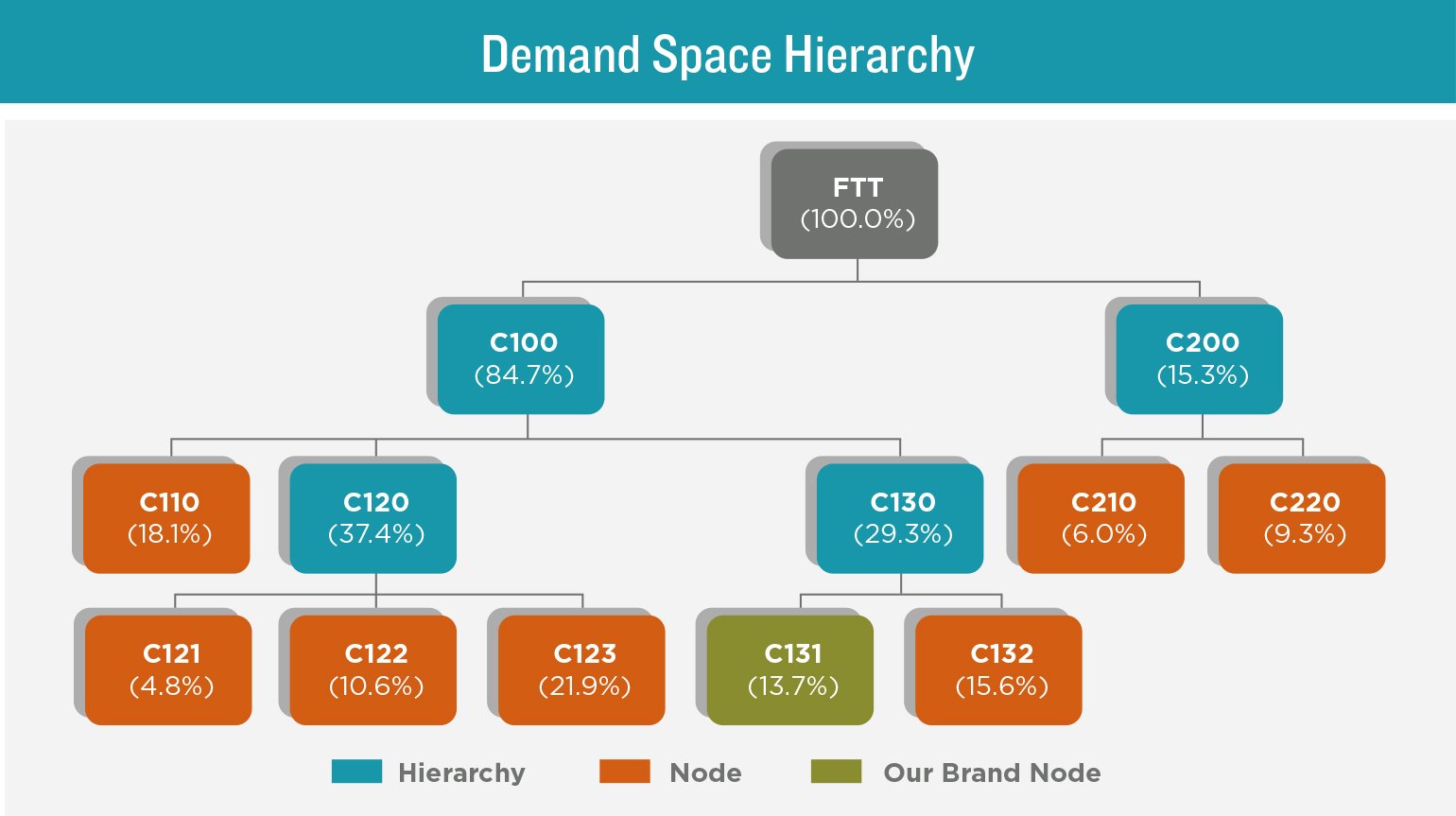

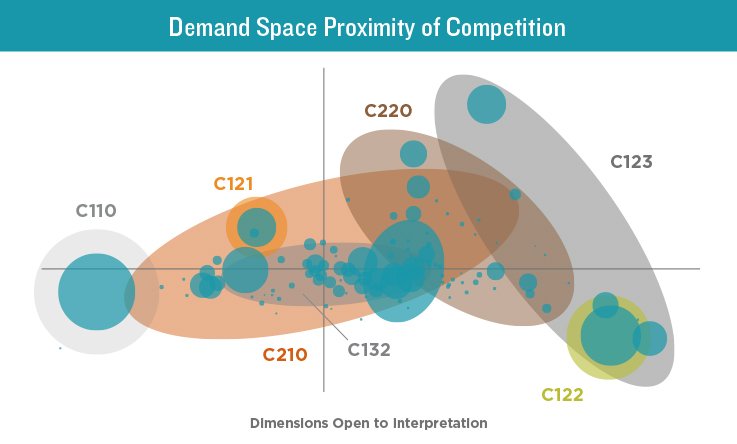

The distances are then organized into like groups by demand space based on a hierarchical cluster analysis. This generally results in between 8 and 12 groups (nodes) of products separated in a binary hierarchical fashion. It also explains 80% to 90% of the variance across distances like in this example:

More importantly, the same models can be immediately used for simulation in the CIA scenario planning software. Subsequent tools in Microsoft office allow clients to perform drill and pivot analyses across the entire competitive set. Part of the current Market Structure deliverable are transferred demand reports that will depict Sources of Volume (SOV) and Fair Share Indices (FSI) for all the competitors in the category. We’d love to share more if this sounds interesting for you and your organization.

Middlegame is the only ROMI consultancy of its kind that offers a holistic view of the implications of resource allocation and investment in the marketplace. Our approach to scenario-planning differs from other marketing analytics providers by addressing the anticipated outcome for every SKU (your portfolio and your competitors’) in every channel. Similar to the pieces in chess, each stakeholder can now evaluate the trade-offs of potential choices and collectively apply them to create win-win results.