Recently, Middlegame leveraged our novel tool, the Competitive Interaction Analysis (CIA)®, for a very unique purpose. A Middlegame client wanted to a more customer-based evaluation of brand equity. She had worked with other researchers applying conjoint analysis, but was worried about the lack of accounting for the full marketing mix as well as very different channel dynamics that the brand was experiencing.

Like conjoint, the Fader and Hardie (1996) approach arrives at market-share forecasts for imitative new products by characterizing each SKU in a competitive category as a combination of its product attributes, i.e. brand name, package size, flavor, variety, type, etc. The forecasts are merely the projection of new combinations of product characteristics. The significance of these forecasts is the ability to disentangle the brand name from other product attributes, price, promotion, and distribution…the 4Ps. As I explained in another blog, Fader and Hardie (1996) is the foundation of CIA®, making this duo among our Middlegame heroes.

Another one of Middlegame’s heroes is Len Lodish. In his 2000 study with Bhattacharya, he leverages the same disentangling facet of Fader and Hardie in their pursuit of measures to track the health of a brand. Brand health is identified as a combination of “current well-being” and “resistance” in an analogous notion to similar concepts found in the established epidemiology literature. Current well-being is expressed as a series of metrics for how the brand name impacts a product’s sales under typical conditions. Empirical evidence demonstrates this as being the first operationalization of customer-based brand equity. The blueprint to address the client issue was clearly in place.

We soon learned that the brand in question was not part of the client portfolio, but was a competitor in their same category. The brand was actually being evaluated as part of an acquisition to make a better foothold in the “health and wellness” subset of products.

The finance team wanted to know to what extent the brand name was separated from price-driven incentives that would need to continue to fuel after the transaction finalized. However, they knew the brand name improved those promotions. Use of the retail tracking data to explain the value of a brand name as well as the differential effectiveness of the brand’s marketing made CIA® ideal to address the problem.

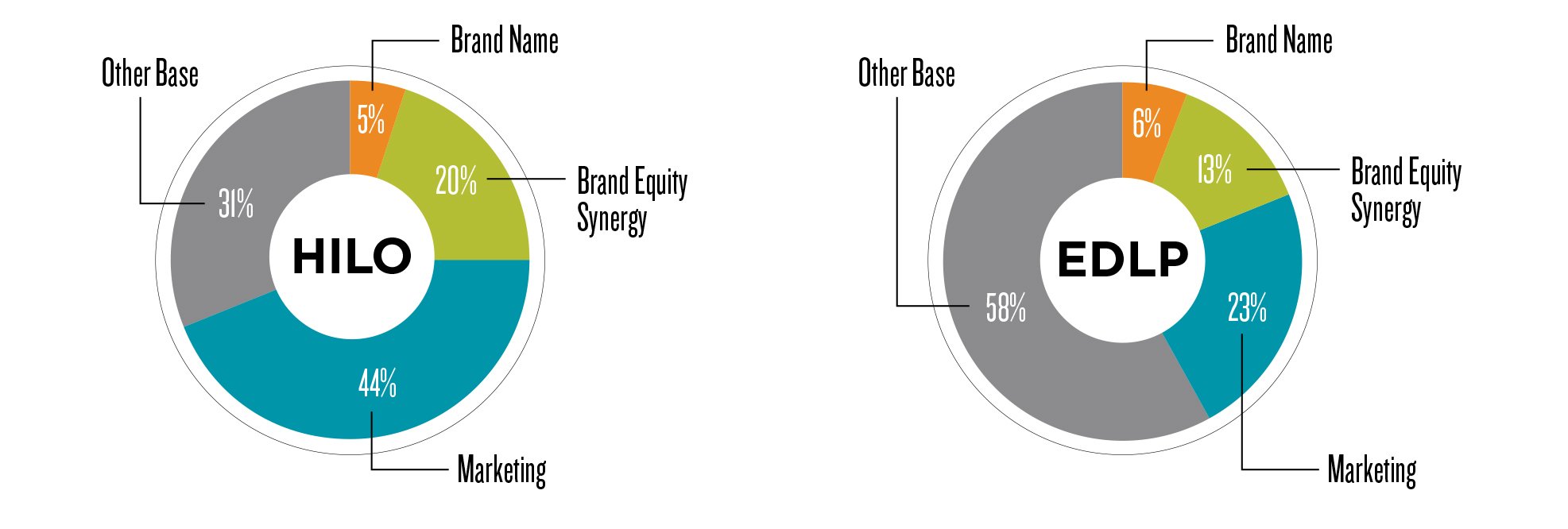

Before taking on our typical “incrementality versus transferred demand” script, we found that retailer outlets that followed a HILO format actually had a very different brand equity assessment than those that were predominantly EDLP.

Base price is fairly ambiguous in HILO due to heavy trade support, but brand equity plays a significant role in these stores and represents 45% of what would be considered base sales (5% + 20%) divided by (100% – 44%). On the other hand, EDLP is far more base driven, but less dependent on brand equity. Here it was 25% of base: (6% + 13%) divided by (100% – 23%). Therefore, EDLP is far more dependent on the everyday or base price. Unfortunately, this brand was way more dependent on the EDLP stores for the current volume they offered.

As expected, the finance team conversation was strictly about the facts. We didn’t get any feedback on our recommendation to forgo the acquisition, but as of December 1, 2016, we haven’t seen any news in the trade journals to suggest that the deal proceeded. In fact, we recently participated in a series of meetings to address extending an existing brand in the portfolio into the health and wellness subset of products.

Middlegame is the only ROMI consultancy of its kind that offers a holistic view of the implications of resource allocation and investment in the marketplace. Our approach to scenario-planning differs from other marketing analytics providers by addressing the anticipated outcome for every SKU (your portfolio and your competitors’) in every channel. Similar to the pieces in chess, each stakeholder can now evaluate the trade-offs of potential choices and collectively apply them to create win-win results.